If one of the parties files a nonresident return for a second state, there typically is no adjustment you need to make.

This is because the resident state typically allows a credit for the tax paid to the nonresident state, limited to the amount of tax that would apply to that income in the resident state.

So, in most cases, there is nothing you need to do to reflect tax paid to another state.

The software does have special handling for the following situations:

- Party lives in Connecticut and works in New York

- Party lives in Connecticut and works in New Jersey.

- Party lives in New York and works in New Jersey.

- Party lives in New York and works in Connecticut.

- Party lives in New Jersey and works in New York.

- Party lives in New Jersey and works in Connecticut

If one of these special situations applies, do the following:

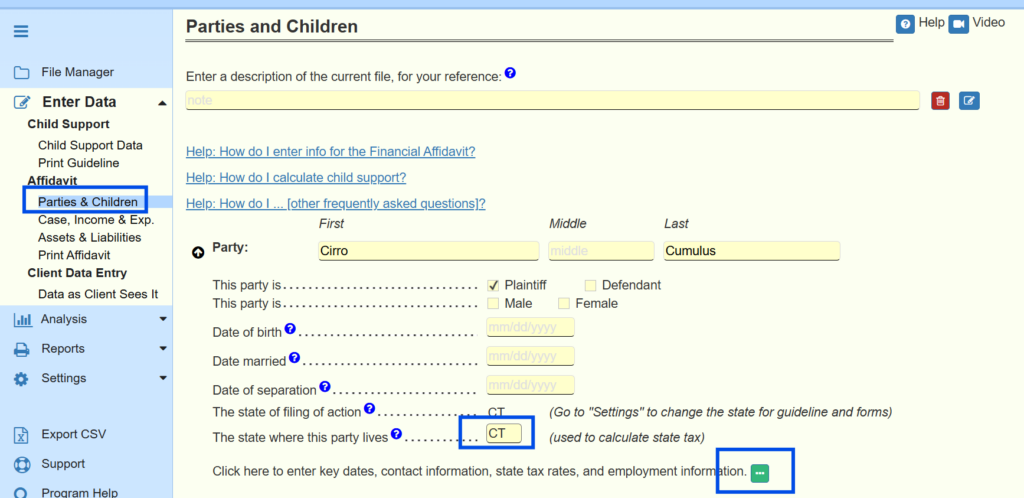

If your client lives in Connecticut but works in New York, you can specify that as follows.

- On the Parties & Children screen, specify the state where the party lives.

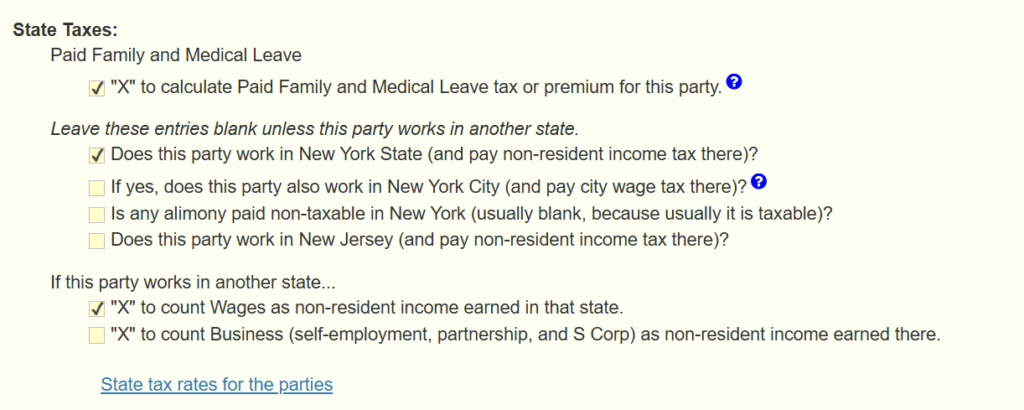

- Click the “more info” button, and specify the state where the party works.

- If appropriate, also click the checkbox for New York City.

- Fill in the boxes about nonresident income.

The software will then calculate taxes appropriately.

You will see the detail on the report for state income taxes.

To see that report, go to the View/Edit Taxes report, scroll to the bottom, and click “more info” on the line for state taxes.

For states other than these, there is a credit for taxes paid to another state.

- If taxes are higher where the client lives than where the client works, then there is no need to do anything special, because the tax will be the same as if the client worked in-state.

- If taxes are higher where the client works than where the client lives, you will need to override to show the impact of the tax paid to the state where they work. This is because the tax paid to the state where they work will be more than the credit given by the state where they live.

- Some states have reciprocity, where there is no impact of working in a different state. For more information, search for “state income tax reciprocity agreements.”