448.1

Released January 8, 2026

For everyone

- Minimum wage. Updated the software’s default minimum wage to match all states 2026 rates.

State specific

Florida

- Updated arrears interest rate.

New York

- Net Worth Statement. Income taxes are no longer being included in total expenses.

- Minimum wage. In updating minimum wage, switched to using the New York City/Long Island/Westchester minimum wage rate for New York ($17/hour) instead of the “rest of state” rate ($16/hour). This is just the initial entry, and you can always change it in a particular case.

Pennsylvania

- Child support. Released updated child support guidelines, effective 1/1/2026

- New guideline table. Increased child support at each income level (Rule 1910.16-3).

- Self Support Reserve increased from $1,063 to $1,255 (Rule 1910.16-2).

- High-income child support numbers updated to match new guidelines (Rule 1910.16-3.1).

- Revised “Unreimbursed Medical Expenses Over $250” help text to (1) include psychiatric or psychological services in generally included expenses, effective 7/1/2025 and (2) remove text about recurring/predictable expenses (Rule 1910.16-6(c)).

447.22

Released December 17, 2025

For everyone

- Log in. If you log in to the wrong site (for example, log in at pro.flsgo.com when it should be client.flsgo.com), the login screen will now redirect you to the correct site.

- Files with contention. Now, if a second user opens a file that a first user was using, the first user is told what happened, including the name of the person who opened the file. Previously, the first user just got a message, “No File Loaded.” Also, the second user, upon attempting to open the file, is now told the name of the person who has the file open and the number of minutes left until the second person can open the file. We allow the second person to open the file if the first user closes the file or is idle for 15 minutes.

State specific

Massachusetts

- We have released the updated child support guideline, which became effective December 1, 2025. Here are the key changes:

- Table A and the child care amount have been updated.

- The Social Security dependency benefits section was revised and expanded.

- There were a number of formatting changes on the face of the form, including a new Worksheet Summary.

New York

- We have released the newly-revised New York Net Worth Statement. Here are the changes:

- Family Data, Expenses, and Income

- There’s a new section (i) in Family Data for written agreements between the parties.

- In Section II(b), there’s a new line for streaming expenses.

- In Section II(e), the line for Workers’ Compensation insurance has been removed.

- In Section II(f), there are new lines for children’s unreimbursed medical, dental, optical, prescription, and mental health expenses and for orthodontist expenses.

- In Section II(i), lease payments and loan payments are entered separately; the line for public transportation expenses has been moved to the section for recreation expenses; and the line for tolls has been combined with parking. If entering expenses by vehicle, there is no longer a section for entering expenses not associated with a vehicle.

- In Section II(k), vacation expenses are now broken down between Family and Self.

- In Section II(m), there are new lines for Diapers/Formula and Gifts to Children.

- There are text changes in III (a) and (b).

- There is a new line III.(c)5.(b) for children’s derivative Social Security income. This field is for the Net Worth Statement only and does not affect the Budget Report or cash flow projections.

- There is a new line III.(c)13. for a non-party person residing in the household.

- Former line III.(c) (relating to an employed child) has been removed.

- Former line III.(d) (relating to support received under court order) is now line III.(c)14.

- Former line II.(l)6 (tax refund) is now line III.(c)15.

- Former line III.(e) (other income) is now line III.(c)16.

- Income taxes and FICA now appear with income, instead of expenses (line III.(d).

- Assets

- There is a new section K13 for Electronic Payment Accounts.

- There is a new section L14 for Cryptocurrency.

- Investments are now in section B4, and there is a new line for Financial Institution.

- With retirement accounts, there are new lines for Financial Institution and Account Number.

- There is a new line for Financial Institution in the section for Other Assets (M15).

- For Jewelry, etc., the order of valuation dates is switched.

- For Contingent Interests, there is a new line for Financial Institution.

- Liabilities and Final Section

- In the Credit Card section, there are new lines for Creditor and the last 4 digits of the account number.

- The Installment Accounts section has been removed. Any Installment Accounts will appear with Other Liabilities.

- The section saying how many Statements of Net Worth have been filed has been moved and reformatted.

- There is a new Date field near the Signature field.

- There is additional text for the attachments.

- Family Data, Expenses, and Income

Washington State

- New Guideline. We updated the child support guideline table. Here are the changes:

- The guideline table has been updated. The support amount at a given level of income is higher than it was before.

- The new table goes up to $50,000 in combined monthly income, an increase from $12,000 under the previous table.

- The minimum amount a parent paying support must retain for themselves (the “self-support reserve”) is increasing to 180% of the federal poverty level.

- The minimum combined monthly income for lower-income families is raised from $1,000 to $2,200.

We now default to the new table, and the user can change to the previous table if necessary.

447.21

Released December 2, 2025

For Everyone

Copy emailed files. There is a new settings option that allows you to have copies of all emails to be sent to the professional’s email. This is for use by financial professionals who by regulation or policy need to retain copies of all correspondence relating to a case.

More things to know about this option:

- Currently, this option sends copies of emails to other people, but not copies of emails sent to tech support. We are working on adding that capability.

- The option will send emails to the relevant professional, even if the person logged in and doing the emailing is a member of the staff.

- The option must be set by the person who is logged in. It can not be set at the firm level, and a professional can not set it for staff. Staff must set it when they log in as well.

447.20

Released November 29, 2025

For Everyone

New log-in. We have a new log-in screen and new processes on the back end. This should pave the way for the introduction of optional 2-factor authentication, which we are working on now.

PDFs. In the Cloud software, PDFs now open only in the browser. Previously, we also popped up a dialog asking for a download location. Now, you can download after the PDF appears in the Browser.

Time-outs. We have improved the way time-outs work. Previously, if a person logged in to two tabs or two browsers, it was possible for them to get locked out of a file they were editing. That no longer happens.

File contention. We have improved the way the software responds when two users of the Firm edition try to open the same file. Now, the second person will be able to open the file if the first person closes the file, or if the first person is idle for 10 minutes. So if the second person needs immediate access, they can contact the first person and ask them to close the file or log out. If the first person is away and unreachable, then the second person will be able to open the file after 10 minutes.

State Specific

California

- Judicial Council Forms. We updated the following Judicial Council forms: FL-165, FL-300, FL-306, FL-313, FL-320, FL-341(B), FL-346, CIV-050.

447.19

November 5, 2025

For Everyone

IRS inflation updates. The release includes the inflation updates for 2026, recently published by the IRS in Revenue Procedure 2025-32. The updates include the 2026 values for:

- Tax brackets (the rates are not automatically adjusted, but brackets are).

- Standard deduction (and the extra standard amounts for individuals who are blind or over age 65).

- Child Tax Credit (does not change from 2025 to 2026).

- Child Care Credit.

- Earned Income Credit parameters.

- Qualified Business Income thresholds

- Alternative minimum tax parameters.

- Student Loan Interest Deduction phase-out thresholds

These changes affect 2026 results. We had previously made estimates of the inflation adjustments, so the changes from prior 2026 results are minimal.

State Specific

California

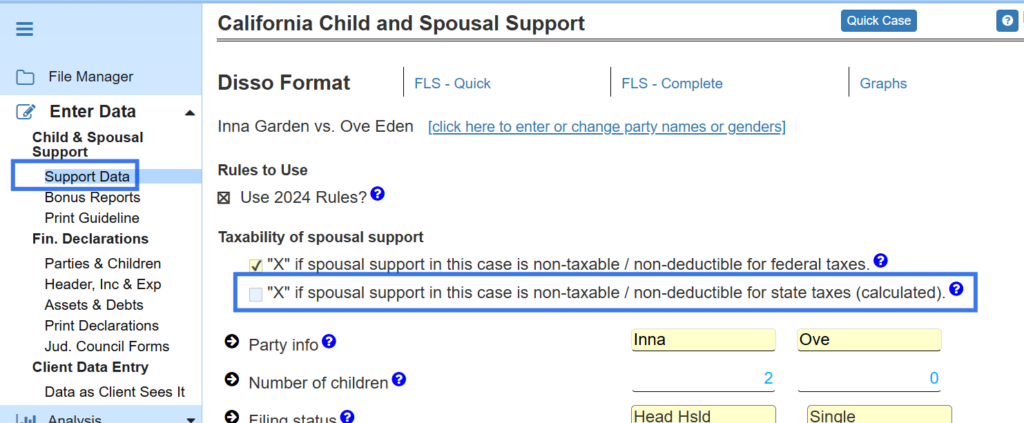

- Spousal support. Starting in 2026, spousal support will no longer be taxable or deductible for California state tax purposes. While nothing is changing immediately, the software is now coded to change its calculation to not make spousal support deductible, starting on January 1, 2026. You may override this calculation at the top of the screen where you enter child and spousal support data, as shown below.

- Judicial Council forms. We have updated Judicial Council forms FL-145, FL-165, FL-300, FL-306, FL-312, FL-320, FL-340, FL-341(B), FL-343, and CIV-050.

Massachusetts

- Investments. Adding a large number of investments will no longer cause the software to log out.

New Jersey

- Blank CIS. On the “Print CIS” page, the link to the blank CIS now links to the most recent one.

447.18

October 14, 2025

For Everyone

This release introduces our new improved login.

- The login uses more modern technology and will be more secure.

- If you log in to the wrong site (client, pro, my), the login will automatically redirect you to the appropriate site.